Table of Contents Show

Boost productivity and streamline finances with the best digital wallets available in 2024, enhancing efficiency, security, and business growth.

Uncover the advantages of the best digital wallets for maximizing productivity and solidifying financial procedures.

Discover how the best digital wallets can amplify your productivity by simplifying financial management, enhancing security, and promoting business growth.

1. Importance of Digital Wallets in Boosting Productivity

Leveraging the power of digital wallets can transform your productivity. It streamlines financial transactions, enhances security, and automates routine payment processes, ensuring you spend more time on core business activities instead of handling cash. These benefits are unparalleled in their potential to boost productivity.

Digital wallets transform productivity by streamlining transactions, enhancing security, and automating payments, freeing you to focus on core business activities.

Integrating digital wallets into your business operations can significantly propel efficiency. With features such as cross-platform compatibility, ease of use, and integration with productivity apps, digital wallets present an underutilized opportunity for businesses to reach new productivity heights.

a. Increased Efficiency

Digital wallets have emerged as a game-changer, turbocharging productivity by accelerating workflows and simplifying operations. They facilitate transactions at lightning speed, thereby increasing overall efficiency and allowing businesses to focus more on their core functions.

- Facilitates rapid transactions

- Minimize interruptions in workflows

- Allows you to focus more on primary business operations

b. Streamlined Financial Management

Using digital wallets can significantly streamline financial management. These tools facilitate seamless organization of your finances, assisting in tracking expenses, handling invoices, and categorizing expenditure in an organized manner.

- Use digital wallets to track your daily, weekly, and monthly expenses.

- Use digital wallets for prompt invoicing and payment processing.

- Use digital wallets to categorize spending into different buckets like travel, dining, utilities, etc.

c. Enhanced Security

As an entrepreneur or a manager, enhancing the security of your transactions is paramount. Thankfully, digital wallets come packed with top-tier security features that guard your finances effectively.

- Banking on Safety: With end-to-end encryption and multi-authentication protocols, digital wallets ensure your financial data stays safely guarded.

- Guarding Your Finances: The use of biometric data like fingerprints or face recognition adds an extra layer of protection to your transactions, preventing unauthorized access.

2. Key Features to Look for in Digital Wallets

Before choosing a digital wallet, delve into its minutiae. High-performing wallets harmonize across multiple platforms, offering a streamlined, user-friendly experience. Seamless integration with productivity applications is another benchmark.

Noticeable characteristics of trustworthy digital wallets extend beyond just safety. Instrumental features like ease of use and cross-platform compatibility are paramount. Importantly, look for the ability to merge with productivity apps for enhanced efficiency.

a. Cross-Platform Compatibility

In our tech-saturated world, choosing a digital wallet that’s cross-platform compatible serves as an invaluable tool. It’s a key to sustaining seamless financial transactions and enhancing productivity across varied operating systems.

- Cross-platform compatibility bridges the gap between various operating systems, fostering a more connected financial ecosystem.

- With the omnipresence of mobile technology, a cross-platform digital wallet broadens your financial accessibility and ease of use.

- The adaptability of cross-platform wallets allows for updates and enhancements across all platforms simultaneously, ensuring you enjoy the latest features.

b. Ease of Use

When it comes to productivity, a digital wallet’s simplicity and ease of use matter. A user-friendly platform accelerates transaction speed and minimizes time spent on financial tasks, thereby boosting productivity.

With an intuitive digital wallet, you eliminate the learning curve. This means you can get started instantly, saving time that you can allocate to other productive endeavors.

An easy-to-use wallet is the need of the hour for busy entrepreneurs and managers. It can not only simplify transactions but also allow them to shift focus from finance management to growth initiatives.

c. Integration with Productivity Apps

Integrating your digital wallet with productivity apps forms a robust toolkit that amplifies overall efficacy. Only by unifying these digital tools can one truly maximize their productivity, aligning financial transactions and project management under one streamlined system.

The integration of digital wallets with productivity apps enables a synchronized work process. It cuts down on wasted time switching between applications and keeps your focus razor-sharp. As a result, efficiency skyrockets, and tangible goals are met in record time.

Productivity apps in your digital wallet minimize time-consuming financial tasks, making daily transactions effortless and straightforward. This free time unchains your productivity potential, letting you focus on the ‘bigger picture’ and achieve more.

Top Digital Wallets for Boosting Productivity

1. AliPay

AliPay is a popular digital wallet that originated in China and has gained global recognition. It offers a wide range of features that make it a powerful tool for boosting productivity. Here are some key features of AliPay:

- Secure and Convenient: AliPay uses advanced encryption technology to ensure the security of your financial transactions. It also offers a seamless and user-friendly interface, making it easy to navigate and use.

- Mobile Payments: With AliPay, you can make payments directly from your mobile device. This eliminates the need to carry cash or credit cards, making transactions quick and hassle-free.

- International Transactions: AliPay allows you to make payments and transfer money internationally, making it a convenient option for businesses with global operations.

- Integration with Other Services: AliPay integrates with a wide range of other services, such as e-commerce platforms, transportation services, and utility bill payments. This makes it a versatile tool for managing various aspects of your life.

- Rewards and Discounts: AliPay offers various rewards and discounts to its users, encouraging them to use the app and save money on their purchases.

Overall, AliPay is a reliable and feature-rich digital wallet that can help boost productivity by simplifying financial transactions and offering a range of convenient features.

2. Samsung Pay

Samsung Pay is a popular digital wallet that is compatible with a wide range of Samsung devices, including smartphones and smartwatches. It offers a host of features that make it a convenient and efficient tool for boosting productivity. Here are some key features of Samsung Pay:

- Wide Compatibility: Samsung Pay is compatible with a large number of payment terminals, including both NFC (Near Field Communication) and MST (Magnetic Secure Transmission) terminals. This means you can use Samsung Pay to make payments at a wide range of merchants, even if they don’t have NFC technology.

- Secure and Private: Samsung Pay uses multiple layers of security to protect your payment information. It uses tokenization to ensure that your card details are never stored on your device or shared with merchants, making it a secure option for making payments.

- Loyalty and Membership Cards: Samsung Pay allows you to store and use your loyalty and membership cards digitally. This means you can easily access and use your cards without the need to carry physical cards, helping you stay organized and save time.

- Quick Access: Samsung Pay can be accessed quickly and easily with a simple swipe up gesture from the lock screen or home screen of your Samsung device. This makes it convenient for making payments on the go without the need to navigate through multiple screens or apps.

- Integration with Samsung Services: Samsung Pay integrates seamlessly with other Samsung services, such as Samsung Health and Samsung Rewards. This allows you to earn rewards and track your transactions within the Samsung ecosystem.

Overall, Samsung Pay is a versatile and user-friendly digital wallet that offers a wide range of features to enhance productivity. Its compatibility, security, and integration with Samsung devices and services make it a convenient option for managing your payments and loyalty cards.

3. Apple Pay

Apple Pay is a widely used digital wallet that is exclusive to Apple devices, including iPhones, iPads, and Apple Watches. It offers a range of features that make it a convenient and secure tool for boosting productivity. Here are some key features of Apple Pay:

- Contactless Payments: Apple Pay allows you to make contactless payments using your Apple device. Simply hold your device near a compatible payment terminal and authenticate the transaction with Face ID, Touch ID, or your device passcode.

- Secure and Private: Apple Pay prioritizes the security and privacy of your payment information. It uses tokenization to ensure that your card details are never shared with merchants, reducing the risk of fraud. Additionally, Apple does not store your transaction history or share it with third parties.

- Integration with Apple Wallet: Apple Pay seamlessly integrates with Apple Wallet, allowing you to store and access your payment cards, boarding passes, event tickets, and more in one convenient location. This helps you stay organized and eliminates the need to carry physical cards or tickets.

- In-App and Online Payments: Apple Pay can be used to make secure payments within apps and on websites that support Apple Pay. This streamlines the checkout process and eliminates the need to manually enter payment and shipping information.

- Peer-to-Peer Payments: With Apple Pay, you can easily send and receive money from friends and family using the Messages app. This makes splitting bills or paying back borrowed money quick and hassle-free.

- Rewards and Offers: Apple Pay offers various rewards and exclusive offers from participating merchants. This allows you to save money and earn benefits while using Apple Pay for your transactions.

Overall, Apple Pay is a user-friendly and secure digital wallet that offers a range of features to enhance productivity. Its seamless integration with Apple devices, contactless payments, and secure tokenization make it a convenient and efficient tool for managing your payments and transactions.

4. PayPal

PayPal is a widely recognized and trusted digital wallet that allows users to send and receive money securely online. It offers a range of features that make it a convenient and versatile tool for boosting productivity. Here are some key features of PayPal:

- Online Payments: PayPal enables users to make secure online payments to merchants around the world. It acts as a middleman, allowing you to link your bank account, credit card, or debit card to your PayPal account and make payments without sharing your financial information with the recipient.

- Peer-to-Peer Payments: With PayPal, you can easily send money to friends, family, or colleagues. Whether you need to split a bill, pay back borrowed money, or send a gift, PayPal’s peer-to-peer payment feature makes it quick and convenient.

- International Transactions: PayPal supports transactions in multiple currencies, making it a convenient option for international payments. It also offers competitive exchange rates and allows you to hold balances in different currencies.

- Seller Protection: PayPal provides seller protection, which helps protect merchants from fraudulent transactions and unauthorized payments. This gives businesses peace of mind when accepting payments through PayPal.

- Mobile App: PayPal offers a mobile app that allows users to manage their accounts, send and receive money, and make payments on the go. The app provides a seamless and user-friendly experience, making it easy to stay productive even when you’re away from your computer.

- Integration with E-commerce Platforms: PayPal integrates with various e-commerce platforms, making it easy for businesses to accept payments on their websites. This integration streamlines the checkout process and helps businesses boost their online sales.

Overall, PayPal is a reliable and widely used digital wallet that offers a range of features to enhance productivity. Its secure online payments, peer-to-peer transactions, international capabilities, and integration with e-commerce platforms make it a versatile tool for managing your finances and boosting productivity.

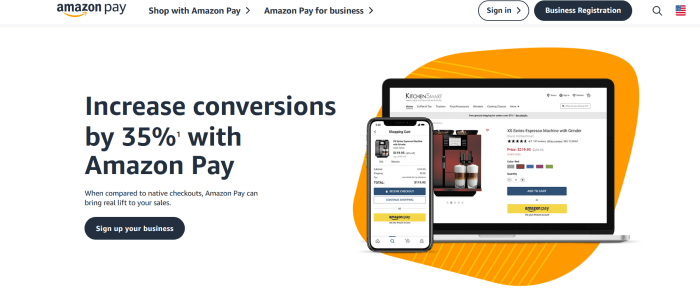

5. Amazon Pay

Amazon Pay is a digital wallet offered by Amazon, one of the largest e-commerce platforms in the world. It provides users with a convenient and secure way to make online payments and manage their finances. Here are some key features of Amazon Pay:

- Seamless Checkout: Amazon Pay allows users to make payments on third-party websites using their Amazon account information. This eliminates the need to enter payment and shipping details manually, streamlining the checkout process and saving time.

- Trusted and Secure: As a service provided by Amazon, Amazon Pay leverages the company’s robust security measures to protect user information and transactions. It uses advanced encryption technology and fraud detection systems to ensure secure payments.

- Buyer Protection: Amazon Pay offers a buyer protection policy that helps safeguard customers’ purchases. If there are any issues with an order, such as receiving a damaged or incorrect item, users can contact Amazon Pay’s customer support for assistance.

- Alexa Integration: Amazon Pay can be used with Alexa-enabled devices, allowing users to make voice-activated payments. This feature provides a hands-free and convenient way to complete transactions, especially for users with smart home setups.

- One-Click Purchasing: With Amazon Pay, users can enable one-click purchasing, which allows for faster and more efficient transactions. This feature is particularly useful for frequent shoppers who want to expedite the checkout process.

- Loyalty Programs: Amazon Pay integrates with various loyalty programs, allowing users to earn and redeem rewards when making purchases. This feature incentivizes customers to use Amazon Pay and provides additional value for their transactions.

Overall, Amazon Pay is a reliable and user-friendly digital wallet that offers a range of features to enhance productivity. Its seamless checkout process, trusted security measures, integration with Alexa, and loyalty program integration make it a convenient option for managing online payments and boosting productivity while shopping.

6. Google Pay

Google Pay is a popular digital wallet developed by Google that allows users to make secure payments using their Android devices. It offers a range of features that make it a convenient and efficient tool for boosting productivity. Here are some key features of Google Pay:

- Contactless Payments: Google Pay enables users to make contactless payments by simply tapping their Android device on a compatible payment terminal. This eliminates the need to carry physical cards or cash, making transactions quick and convenient.

- Secure and Private: Google Pay prioritizes the security and privacy of user information. It uses multiple layers of security, including encryption and tokenization, to protect payment data. Additionally, Google does not share user transaction details with merchants.

- Integration with Google Services: Google Pay seamlessly integrates with other Google services, such as Google Assistant and Google Maps. This allows users to make payments within apps, send money to contacts, and even pay for transportation services, all from one centralized platform.

- Loyalty Cards and Offers: Google Pay allows users to store and access their loyalty cards digitally. This eliminates the need to carry physical cards and makes it easier to earn and redeem rewards. Additionally, Google Pay provides personalized offers and discounts based on user preferences and spending habits.

- Peer-to-Peer Payments: With Google Pay, users can easily send and receive money to and from friends and family. This feature is particularly useful for splitting bills, paying back borrowed money, or sending gifts.

- Online and In-App Payments: Google Pay can be used to make secure payments within apps and on websites that support Google Pay. This streamlines the checkout process and eliminates the need to enter payment and shipping information manually.

Overall, Google Pay is a versatile and user-friendly digital wallet that offers a range of features to enhance productivity. Its contactless payments, secure transactions, integration with Google services, loyalty card storage, and peer-to-peer payment capabilities make it a convenient tool for managing payments and boosting productivity.

7. Walmart Pay

Walmart Pay is a digital wallet offered by Walmart, one of the largest retail chains in the world. It provides customers with a convenient and secure way to make payments in Walmart stores. Here are some key features of Walmart Pay:

- Seamless In-Store Payments: Walmart Pay allows customers to make payments directly from their smartphones within Walmart stores. By scanning a QR code at the checkout, customers can complete their transactions quickly and easily.

- Integration with Walmart App: Walmart Pay is integrated within the Walmart mobile app, making it easy for customers to access and use. Customers can link their payment methods, such as credit cards or gift cards, to their Walmart Pay account for a seamless payment experience.

- Digital Receipts: With Walmart Pay, customers receive digital receipts for their purchases directly in the Walmart app. This eliminates the need for paper receipts, making it easier to track and manage expenses.

- Savings Catcher: Walmart Pay includes a feature called Savings Catcher, which automatically compares prices of purchased items with local competitors. If a lower price is found, customers receive the difference in the form of Walmart eGift cards, helping them save money on their purchases.

- Gift Card Integration: Walmart Pay allows customers to store and use Walmart gift cards within the app. This makes it convenient for customers to redeem gift cards without the need for physical cards.

- Enhanced Security: Walmart Pay prioritizes the security of customer information. It uses encryption technology to protect payment data and does not store credit card information on the device or Walmart servers.

Overall, Walmart Pay is a convenient and secure digital wallet that offers a range of features to enhance the payment experience for customers shopping at Walmart stores. Its seamless in-store payments, integration with the Walmart app, digital receipts, savings catcher feature, gift card integration, and enhanced security make it a valuable tool for managing payments and boosting convenience while shopping at Walmart.

8. WeChat

WeChat is a multi-purpose messaging, social media, and mobile payment app developed by Tencent, a Chinese technology company. It offers a wide range of features that make it a comprehensive and versatile tool for communication and financial transactions. Here are some key features of WeChat:

- Messaging and Social Networking: WeChat allows users to send text messages, voice messages, photos, videos, and documents to individuals or groups. It also offers features similar to social media platforms, such as Moments, where users can share updates, photos, and videos with their contacts.

- Mobile Payments: WeChat Pay is the mobile payment feature within the WeChat app. It enables users to make secure and convenient payments for a variety of services, including in-store purchases, online shopping, utility bills, transportation, and more. WeChat Pay has gained widespread adoption in China and is expanding its availability globally.

- QR Code Payments: WeChat Pay utilizes QR code technology for transactions. Users can scan QR codes displayed by merchants or other users to make payments or receive funds. This makes transactions quick and easy, eliminating the need for physical cash or cards.

- Money Transfers: WeChat allows users to send and receive money to and from their contacts. This feature is particularly useful for splitting bills, repaying debts, or sending gifts to friends and family.

- Mini Programs: WeChat’s Mini Programs are lightweight applications that can be accessed within the app. These mini-apps provide various services, such as food delivery, ride-hailing, ticket booking, and more, without the need to download separate apps.

- Official Accounts: WeChat Official Accounts are used by businesses, organizations, and celebrities to interact with their followers. Users can subscribe to these accounts to receive updates, news, promotions, and customer support.

Overall, WeChat is a comprehensive app that combines messaging, social networking, and mobile payment functionalities. Its features such as messaging, social networking, mobile payments, QR code payments, money transfers, mini programs, and official accounts make it a powerful tool for communication, social interaction, and financial transactions.

9. Zelle

Zelle is a popular digital payment platform that allows users to send and receive money quickly and securely. It offers a range of features that make it a convenient and efficient tool for transferring funds. Here are some key features of Zelle:

- Peer-to-Peer Payments: Zelle enables users to send money directly to friends, family, or anyone else with a U.S. bank account. This makes it easy to split bills, pay back borrowed money, or send gifts without the need for cash or checks.

- Fast and Real-Time Transfers: With Zelle, money transfers are typically completed within minutes. This real-time functionality allows for quick access to funds and eliminates the need for waiting periods associated with traditional bank transfers.

- Easy Setup and Integration: Zelle is integrated with many major banks and financial institutions, making it easy for users to link their bank accounts and start using the service. Users can often access Zelle directly through their existing banking apps or websites.

- Security and Fraud Protection: Zelle prioritizes the security of user information and transactions. It uses encryption and other security measures to protect sensitive data. Additionally, Zelle offers fraud protection to help safeguard users against unauthorized transactions.

- Splitting Bills and Requesting Money: Zelle allows users to split bills with friends or request money from others. This feature simplifies the process of dividing expenses and ensures that everyone pays their fair share.

- Availability and Accessibility: Zelle is widely available and can be accessed through various devices, including smartphones, tablets, and computers. This allows users to send and receive money conveniently, regardless of their location.

Overall, Zelle is a user-friendly and secure digital payment platform that offers a range of features to enhance productivity. Its peer-to-peer payments, fast transfers, easy setup and integration, security measures, bill splitting, and accessibility make it a convenient tool for managing financial transactions and boosting efficiency.

3. How Digital Wallets Can Enhance Your Productivity

Maximizing output becomes a reality with digital wallets. Through automating payment processes and enabling quick transactions, these wallets reshape tedious finance management, empowering you to use time more productively.

Unlock your performance potential with digital wallets. By reducing the mental load associated with financial tasks, these innovative tools allow you to focus on meaningful work, propelling you towards peak productivity.

a. Automating Payment Processes

Automation through digital wallets allows user convenience, ensuring payments are processed without manual intervention. This results in less time managing finances and more time focusing on essential tasks.

Making payments used to be a tedious task, demanding your attention. With automation, digital wallets have redefined this scenario, enabling automatic debits with a single tap.

By reducing time spent on processing payments, automated digital wallets provide extra room for your attention. This feature directly catapults your productivity levels allowing you to engage in other core activities.

A paradigm shift is visible in how productivity has been enhanced with automated payment. Digital wallets have remarkably streamlined this process, leaving you with ample time to manage other essential tasks.

Digital wallets have proven to be more than a payment facilitator. By automating payments, they allow users to allocate time and energy to what truly matters, thereby broadening their productivity spectrum.

b. Enabling Quick and Convenient Transactions

Digital wallets are reshaping transaction dynamics, making payments swift and straightforward. In a flick, funds are moved, heralding the end of old, time-consuming payment methods and freeing up time for more productive tasks.

The convenience element of digital wallets is a game-changer. Forget standing in lines or lengthy bank procedures. Now, transactions can be executed on the go, anytime, thus eliminating payment hassles.

Are you juggling multiple payments daily? Digital wallets consolidate them to a single platform, turning a pile of complex tasks into a clickable action. This creates a smooth, headache-free transaction process, fueling efficiency.

With digital wallets at your service, experiencing delayed transactions or slow payment systems becomes a thing of the past. The ability to perform instant transfers accelerates the pace of business and boosts productivity.

Imagine making a payment in seconds without compromising security. That’s the power of digital wallets. They don’t merely offer speedy transactions; they bring convenience and security together, striking the perfect balance.

Tips for Getting the Most Out of Your Digital Wallet

One way to escalate your workflow is by employing tactical usage of digital wallets. Make full use of their budgeting and expense tracking facets to gain insights into your financial habits and redirect resources intelligently.

Turn your digital wallet into a tool of higher productivity. By setting up reminders and alerts for due payments, you save time and energy. Also, adopt a habit to regularly examine transactions and analyze spending patterns to take full control of your finances.

a. Utilize Budgeting and Expense Tracking Features

Unlock the full potential of your productivity with the budgeting features found in top digital wallets. Create, manage, and adjust your budgets in real-time, leading to informed decision-making and improved control over finances.

With integrated expense tracking functionality, digital wallets offer a tactical edge. Imagine having immediate insight into your spending habits and areas of major expenditure at your fingertips.

Having real-time data on your spending habits enables you to identify potential budget leaks. By knowing where your money is going, you can divert funds intelligently, contributing to your overall productivity

An informed manager can make informed decisions. The combined power of budgeting and expense tracking amplifies your proficiency, paving the way for a productivity surge. So, have you tuned your digital wallet yet?

b. Set Reminders and Alerts for Bill Payments

Digital Wallets amplify productivity by offering handy features like payment reminders and alerts. Consistently being alerted to upcoming payments eliminates the chance of missing out on them, consequently reducing stress and late payment fees.

Imagine never missing a payment deadline again! Payment alerts ensure this, hence enhancing your productivity. Immediate reminders mean your workflow isn’t interrupted by late bill worries, freeing up mental space for more essential tasks.

Applying digital wallets with payment reminders and alerts for bill payments allows entrepreneurs to stay focused on their business roles. Thus, no distraction from constant worries about bill deadlines since the digital wallet takes care of it.

By establishing a regular bill payment schedule through reminders, digital wallets help shape financial discipline. This routine not only improves your financial health but also positively impacts your overall productivity.

Digital Wallets with payment reminders eliminate the need to manually keep track of various bills. Automatic alerts ensure you’re always updated, saving significant time and energy that can be used to enhance your productivity.

c. Regularly Review Transactions and Analyze Spending Patterns

By analyzing your spending patterns with a digital wallet, you empower your productivity. You not only track where your money goes but also get a clear perspective of your financial habits, enabling smart decisions.

Imagine a tool that doesn’t just manage your finances but molds them to boost your productivity. Regular transaction reviews in the digital wallet are a tool, for fine-tuning your financial strategy.

Having your financial transactions at your fingertips can revolutionize your productivity. With the transaction analysis feature of digital wallets, understanding spending trends becomes an easy task.

A digital wallet helps you stay ahead of the game. By regularly reviewing and analyzing your transactions, you’re not just managing your money, you’re refining your productivity practices.

Make the most of your digital wallet to sharpen your financial acuity. Regular reviews of transactions and dissecting your spending patterns efficiently increase your productivity over time.

Conclusion

Digital wallets are a great tool for boosting productivity and getting more done. With their convenience, security, and wide range of features, they can help managers and entrepreneurs stay organized, streamline their financial transactions, and save time. Whether you’re looking for a digital wallet for personal use or your business, the options mentioned in this blog post are some of the best available. So go ahead and choose the one that suits your needs and start reaping the benefits of a more productive and efficient way of managing your finances.

More articles for you: