Table of Contents Show

Managing your finances is not an easy thing to do. You will need to keep track of all your expenses and some technology or software to do this daunting job for you so you won’t need to sit with a pen, paper, and calculator to jot down all your expenditures.

In order to not go out of your monthly budget, you will need to use the personal finance app to get your things in order. In a company or business setting, the finances are mainly managed by accountants using business financial suites, but managing finance at a personal level is always a difficult task.

Mobile apps on Android and iOS devices have made the work easier for people to track, and notify about their personal finances to stay up-to-date all the time and never go out of budget at the end of the month.

Criteria for choosing the best personal finance app:

Our criteria for choosing the best personal finance app is based on the following usability criteria:

- Real-to-time expense tracking

- Notifications and reminders availability

- Easy to use and smooth learning curve

- Stringent budget rules

- Clear saving plan availability

- Ability to set financial goals

Top Personal Finance Apps for Android and iOS You Can Use Now

Here are our top picks for the personal finance apps for mobile devices.

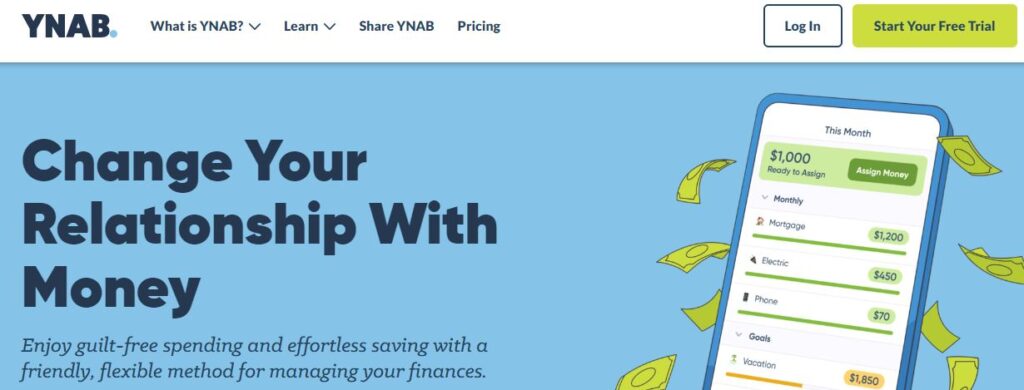

1. YNAB (You Need A Budget)

YNAB is at the top of our list of best personal finance apps, due to its feature for expense tracking and the ability to help you pay your debts on time. This app helps you get out of living on a paycheck and helps you save more money to take you out of debt.

With their four-point rule, YNAB is helping users avoid piling up payments for the end of the month and giving them more control to manage their finances.

This platform offers you a 34-day free trial without inserting credit card information.

Download YNAB: Web | Android | iOS

Key Features:

- Import Transactions

- Set financial/expense goals

- Give dollar job

- Dark mode view available on iOS and Android

- Bank Synchronization

- Transaction matching

- Visual spending and trend report

- Technical support available

Pricing:

- Free 34-day trial

- Monthly package at $11.99/month

- Yearly plan at $84

2. Intuit Mint

Mint (by Intuit) is a free personal finance and budget tracking application to help you understand your spending patterns for optimized saving. It helps you stay focused on your financial goals and help avoid late fees and overage for your payments.

This free financial goal-tracking app can help you set custom budgets, monitor subscriptions, track expenses, and give you personalized insights all-in-one platform.

It is loaded with all the money management features to take you to the next level of financial management for yourself and your business.

The Mint app gives you a very intuitive budget planner so that you can say goodbye to Excel and spreadsheets, and manage all the money on the go. This is a free-to-use app, but if you want to get credit monitoring you can upgrade to premium.

Download: Web Intuit Suite | Android | iOS

Key Features:

- Budget Planner

- Bill payment tracker

- Alerts and notifications

- Investment management

- Credit scoring

- Budget categorization

- Creditcards monitoring and loan management

Pricing:

- Free to use

- Premium credit monitoring service at $16.99/month

3. Clarity Money

Clarity Money is an AI (Artificial Intelligence) powered personal finance management platform available on mobile devices. The AI helps you get personalized suggestions to optimize your money management efforts smartly.

Clarity Money and Marcus is a brand of Goldman Sachs in the USA. It is a free-to-use personal finance management app to help you make better decisions and keep track of your budget.

Using this you can get organized, and save time and money with Clarity Money mobile apps.

Download: Web | Android | iOS | iPad

Key Features:

- Bills and expense organization

- Monitor credit score

- Monitor unwanted subscriptions

- Understand your spending habits

- Multi-level security

- Debt and Investment accounts

Pricing:

- Clarity Money is free to use

4. MoneyStrands

It is a simple and free personal finance app available on mobile devices. It is an easy-to-use, personal finance management app that helps you manage your budget, and expenses in one place.

It helps users consolidate information from all the bank accounts and expense streams to get a complete overview of their budget management. MoneyStrands gives you instant access to your bank accounts, transactions, savings, and spending habits. It gives you the freedom to do more within your financial budget in an efficient manner.

Key Features:

- Budget and transaction tracking

- Saving goals

- Income and expense calendar

- Reporting and analytics

- Community Collaboration

Pricing:

- Free to use

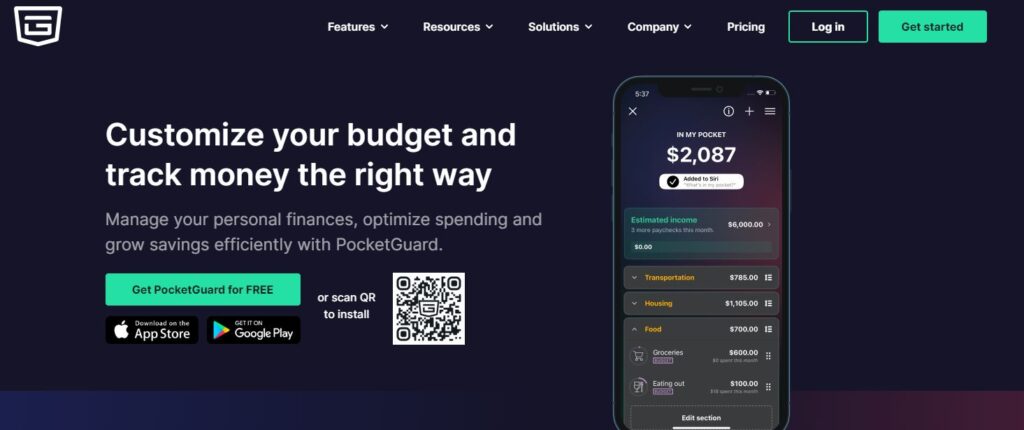

5. PocketGuard

PocketGuard is a useful personal finance, budgeting, and money management app. It helps you take control of your finances and helps avoid overspending. It is an easy-to-use money management application that helps you track your expenses, find ways to save money and track your budget in real-time.

It gives you the ability to keep all your bank accounts in one place, and always know what is in your pocket. It can help you reach your goals with ease and give you clear insights into your spending habits.

Key Features:

- Budget tracking

- Bank accounts and credit card tracking

- Identify and cancel unused subscriptions

- Autosave feature and automation rules

Pricing:

- PocketGuard is free to use

- PocketGuard Plus’s monthly plan is at $3.99

- PocketGuard Plus’s yearly plan is at $34.99

Conclusion

We have highlighted the best personal finance apps you can use today to not miss out on bill payments and avoid late fees. If you have any suggestions, feel free to share them with us.

More Readings: