Table of Contents Show

For private equity businesses, having the right tools to manage deals, investors, and portfolios is crucial for success. A well-designed Customer Relationship Management (CRM) system tailored for private equity firms can be a game-changer, streamlining workflows, enhancing collaboration, and providing valuable insights to drive growth.

As we enter 2025, it’s time to explore the best private equity CRM solutions that can help your firm stay ahead of the curve.

Understanding Private Equity CRM

A private equity CRM is a specialized software solution designed to meet the unique needs of private equity firms. Unlike general CRMs, these platforms offer tailored features for deal management, investor relations, and portfolio monitoring.

By leveraging a private equity CRM, firms can centralize data, automate processes, and gain a comprehensive view of their business, ultimately improving decision-making and driving better outcomes.

Core Features of Private Equity CRM Solutions

To be considered among the best private equity CRM solutions for 2025, a platform must excel in several key areas:

1. Deal Management

Effective deal management is at the heart of any successful private equity firm. The best CRMs offer robust deal-tracking capabilities, allowing users to monitor deals from sourcing to closing. This includes features like deal pipelines, automated workflows, and real-time updates to ensure that no opportunity slips through the cracks.

2. Investor Relationship Management

Building and maintaining strong relationships with investors is critical for private equity firms. The top CRM solutions provide tools for managing investor communications, tracking commitments, and analyzing investor behavior. This helps firms stay on top of investor needs, anticipate potential issues, and foster long-term loyalty.

3. Portfolio Management

Monitoring the performance of a firm’s portfolio is essential for making informed decisions. The best private equity CRMs offer comprehensive portfolio management features, including performance tracking, benchmarking, and scenario analysis. This data-driven approach enables firms to identify trends, spot potential risks, and optimize their investments.

4. Reporting and Analytics

In the world of private equity, data is king. The top CRM solutions provide robust reporting and analytics capabilities, allowing firms to generate customized reports, visualize data, and uncover valuable insights. This empowers decision-makers to make data-driven choices and communicate effectively with investors and stakeholders.

5. Integration Capabilities

Private equity firms often rely on a suite of specialized tools for various functions. The best CRM solutions offer seamless integration with other financial software, such as accounting systems, valuation tools, and fundraising platforms. This ensures that data flows smoothly between systems, reducing manual data entry and minimizing errors.

Top Private Equity CRM Solutions for 2024

Now that we’ve covered the essential features of a private equity CRM, let’s dive into some of the top solutions for 2024:

1. Intapp DealCloud

Intapp DealCloud is a comprehensive CRM platform designed specifically for private equity and investment firms. It streamlines operations, enhances client relationships, and empowers teams to drive growth with its robust, cloud-based solutions.

The platform is tailored to meet the unique needs of financial services, providing essential tools for deal management, investor relations, and performance tracking.

Key Features

- Customizable dashboards for personalized user experience

- Real-time data access for informed decision-making

- Advanced analytics for performance insights

- Pipeline management to track deal progress

- Investor reporting to communicate effectively with stakeholders

- Fund performance tracking for monitoring investment outcomes

- Compliance management to adhere to regulations

- Document management for centralized storage and retrieval

- Collaboration tools to enhance team communication

- Mobile access for on-the-go functionality

- Integration capabilities with other business applications

- User permissions and audit trails for security

- Data visualization tools for better understanding of metrics

- Automated workflows to streamline processes

- Email integration for seamless communication

- Task management features to prioritize activities

- CRM functionality for relationship management

- Custom reporting to meet specific business needs

Drawbacks

- Complex customization options may require technical expertise

- A steep learning curve for new users

- Integration challenges with specific third-party tools

- Some users find the user interface outdated

- Higher cost compared to other CRM solutions

Pricing

- DealCloud starts at approximately $250 per month, but pricing can vary based on customization and additional features required.

- Specific quotes can be obtained directly from DealCloud’s sales team.

2. HubSpot

HubSpot is a widely recognized CRM platform that offers a suite of tools designed to enhance marketing, sales, and customer service efforts. Its user-friendly interface and extensive features make it suitable for businesses of all sizes, including private equity firms looking to manage investor relationships and streamline deal processes.

Key Features

- Contact management to organize and track investor interactions

- Email tracking and notifications for timely follow-ups

- Sales pipeline management to visualize deal stages

- Marketing automation tools to nurture leads

- Reporting dashboards for performance analysis

- Integration with various third-party applications

- Customizable templates for emails and reports

- Task management for prioritizing daily activities

- Social media management tools for brand engagement

- Mobile app for managing CRM on the go

Drawbacks

- Some advanced features require a paid plan

- Limited customization options in the free version

- May become complex for larger teams with extensive needs

Pricing

- HubSpot offers a free tier with basic features, while paid plans start at $50 per month for the Starter package, scaling up to $3,200 per month for the Enterprise level, depending on the features and number of users.

Check this out:

HubSpot vs Zoho: A Comprehensive Comparison of Marketing Software

3. Microsoft Dynamics

Microsoft Dynamics 365 is a powerful CRM and ERP solution that integrates seamlessly with other Microsoft products. It provides a comprehensive suite of tools for managing customer relationships, sales processes, and operational workflows, making it suitable for private equity firms seeking a robust solution.

Key Features

- Unified interface for managing sales, marketing, and customer service

- Advanced analytics and business intelligence capabilities

- Customizable dashboards for personalized insights

- Integration with Microsoft Office and other applications

- Automated workflows to streamline processes

- Lead and opportunity management for tracking sales progress

- Customer service tools for managing investor inquiries

- Mobile access for managing relationships on the go

- AI-driven insights for predicting trends and behaviors

- Security features for data protection and compliance

Drawbacks

- Can be expensive, especially for smaller firms

- Complex setup and customization may require IT support

- Learning curve for users unfamiliar with Microsoft products

Pricing

- Microsoft Dynamics pricing starts at $65 per user per month for the Sales Professional plan, with additional costs for advanced features and integrations.

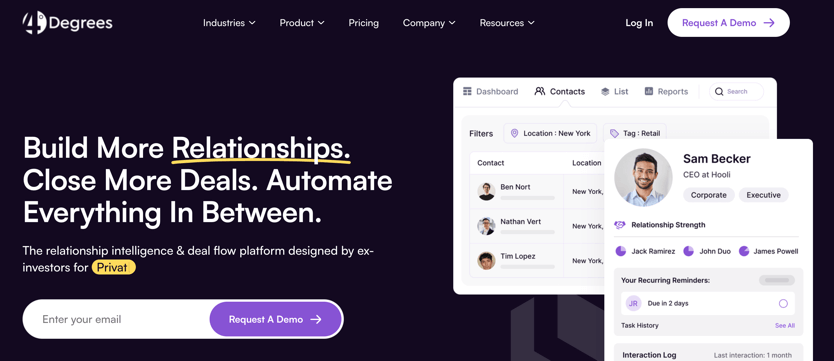

4. 4Degrees

4Degrees is a CRM solution designed specifically for private equity and venture capital firms. It focuses on relationship intelligence, helping firms manage their networks and improve deal sourcing and investor relations through data-driven insights.

Key Features

- Relationship mapping to visualize connections

- Automated data capture to reduce manual entry

- Deal tracking to monitor progress and outcomes

- Investor management tools for tracking commitments

- Customizable dashboards for personalized insights

- Integration with various third-party applications

- Mobile access for managing relationships on the go

- Reporting features for performance analysis

- Task management to prioritize activities

- Collaboration tools to enhance team communication

Drawbacks

- Limited features compared to larger CRM platforms

- Some users may find the interface less intuitive

- Pricing may be a barrier for smaller firms

Pricing

- 4Degrees offers custom pricing based on the specific needs of the firm. Interested users should contact their sales team for a tailored quote.

5. Altvia

Altvia is a CRM built on Salesforce specifically designed for private equity and alternative investment firms. It offers tools for managing deal flow, investor relations, and portfolio monitoring, making it a robust option for these firms.

Key Features

- Deal pipeline tracking for managing investment opportunities

- Fundraising management tools to streamline capital raising

- Custom reporting and dashboards for performance insights

- Investor relationship management features

- Document storage and sharing capabilities

- Compliance tracking to adhere to regulations

- Integration with Salesforce for enhanced functionality

- Customizable checklists for due diligence processes

- Mobile access for managing deals on the go

- Collaboration tools to facilitate team communication

Drawbacks

- May require manual data entry, limiting automation

- Higher pricing compared to some competitors

- Learning curve for users unfamiliar with Salesforce

Pricing

- Altvia’s pricing is customized based on the firm’s needs, with potential costs starting at around $1,000 per month. Interested firms should contact Altvia for a detailed quote.

6. Dynamo

Dynamo is a comprehensive platform that combines CRM capabilities with back-office functionality for private equity, investment banking, and asset management firms. It provides tools for managing investor relations, deal tracking, and operational workflows.

Key Features

- End-to-end platform for managing investments and relationships

- Customizable workflows to fit specific operational needs

- Investor management tools for tracking commitments

- Deal tracking features for monitoring progress

- Integration with popular SaaS tools used in finance

- Reporting and analytics for performance insights

- Document management for secure storage and retrieval

- Mobile access for managing relationships on the go

- Dedicated support for user assistance

Drawbacks

- Not solely a CRM, which may lead to unnecessary complexity

- Requires manual data entry for maintaining up-to-date contacts

- Pricing may be on the higher side for smaller firms

Pricing

- Dynamo’s pricing is tailored to the specific needs of each firm. Prospective users should contact Dynamo for a personalized quote.

7. Clienteer

Clienteer is a CRM solution designed for private equity and investment firms, focusing on relationship management and deal tracking. It offers a user-friendly interface and customizable features to meet the needs of financial professionals.

Key Features

- Deal tracking to monitor investment opportunities

- Investor relationship management tools

- Customizable dashboards for personalized insights

- Reporting features for performance analysis

- Integration capabilities with other financial applications

- Task management for prioritizing activities

- Document management for secure storage

- Mobile access for managing relationships on the go

- Collaboration tools to enhance team communication

Drawbacks

- Limited advanced features compared to larger platforms

- Some users may find customization options lacking

- Pricing may be a consideration for smaller firms

Pricing

- Clienteer’s pricing is customized based on the firm’s requirements. Interested users should reach out to Clienteer for a tailored quote.

8. SatuitCRM

SatuitCRM is a CRM solution specifically designed for investment management firms, including private equity. It focuses on investor relations and fundraising, providing tools to help firms manage their relationships effectively.

Key Features

- Investor tracking to monitor commitments and interactions

- Fundraising management tools to streamline capital raising

- Reporting and analytics for performance insights

- Document management for secure storage and retrieval

- Customizable dashboards for personalized insights

- Integration capabilities with other financial tools

- Mobile access for managing relationships on the go

- Collaboration tools to enhance team communication

Drawbacks

- May lack some advanced features found in larger CRMs

- Pricing can be a barrier for smaller firms

- Some users report a learning curve for new features

Pricing

- SatuitCRM offers customized pricing based on the specific needs of the firm. Interested users should contact SatuitCRM for a detailed quote.

9. SugarCRM

SugarCRM is a flexible CRM platform that offers a range of features suitable for various industries, including private equity. It provides tools for managing customer relationships, sales processes, and operational workflows.

Key Features

- Customizable dashboards for personalized insights

- Sales automation tools to streamline processes

- Reporting and analytics for performance tracking

- Integration with various third-party applications

- Workflow automation to enhance efficiency

- Mobile access for managing relationships on the go

- Customer support tools for managing inquiries

- Security features for data protection

Drawbacks

- May require technical expertise for advanced customization

- Some users find the interface less intuitive

- Pricing can vary significantly based on features and users

Pricing

- SugarCRM’s pricing starts at approximately $40 per user per month for the basic plan, with additional costs for advanced features and customizations.

10. Zoho CRM

Zoho CRM is a popular and affordable CRM solution that offers a wide range of features for managing customer relationships. It is suitable for businesses of all sizes, including private equity firms looking to enhance their investor relations and deal management processes.

Key Features

- Contact management to organize and track investor interactions

- Sales pipeline management to visualize deal stages

- Email automation tools for nurturing leads

- Reporting dashboards for performance analysis

- Integration with various third-party applications

- Customizable templates for emails and reports

- Task management for prioritizing activities

- Mobile app for managing CRM on the go

- Social media integration for brand engagement

- AI-driven insights for predicting trends and behaviors

Drawbacks

- Some advanced features require a paid plan

- Limited customization options in the free version

- May become complex for larger teams with extensive needs

Pricing

- Zoho CRM offers a free tier with basic features, while paid plans start at $12 per user per month for the Standard plan, with additional pricing tiers available for more advanced features.

Related:

Best Zoho Alternatives For Businesses

Choosing the Right Private Equity CRM

Selecting the right private equity CRM requires a thorough understanding of your firm’s unique requirements. Start by identifying your key pain points and goals, such as improving deal flow, enhancing investor relations, or streamlining portfolio management.

Then, evaluate potential CRM solutions based on their ability to address these needs, considering factors such as scalability, flexibility, and ease of use. It’s also essential to assess the vendor’s reputation, support, and implementation process.

Choose a provider with a proven track record in the private equity industry, strong customer references, and a commitment to ongoing support and innovation.

Best Practices for Implementing a Private Equity CRM

Implementing a private equity CRM is not a one-time event but rather an ongoing process that requires careful planning, stakeholder engagement, and continuous optimization. Here are some best practices to ensure a successful CRM implementation:

- Engage stakeholders and secure buy-in: Involve key stakeholders, such as deal teams, investor relations professionals, and portfolio managers, in the CRM selection and implementation process. This helps ensure that the chosen solution meets their needs and fosters adoption.

- Develop a comprehensive data management strategy: Establish clear data governance policies, standardize data entry processes, and implement data quality checks to ensure that your CRM contains accurate, up-to-date information.

- Train staff and ensure adoption: Provide comprehensive training to all CRM users, emphasizing the system’s benefits and how it can streamline their workflows. Encourage user feedback and promptly address any concerns or challenges to maintain high adoption rates.

- Continuously optimize and improve: Monitor CRM usage, gather user feedback, and regularly review the system’s performance against your firm’s goals. Use this information to identify areas for improvement and implement updates or enhancements as needed.

Conclusion

We have highlighted some of the best CRMS that private equity firms can utilize to make their business a success. By investing in a well-designed private equity CRM solution, firms can streamline workflows, enhance collaboration, and gain valuable insights to drive growth.

As we enter 2025, it’s time to explore the best private equity CRM solutions that can help your firm stay ahead of the curve and achieve your goals.

Share your feedback on the best private equity firm CRM you are using at hi@productivityshift.com

More Readings For You: